For Canadian Muslims planning Umrah packages, insurance is essential, offering financial protection against trip cancellations, medical emergencies, and lost luggage. Specialized Umrah insurance from Canada providers covers cultural needs, including medical evacuation and emergency assistance. When choosing a plan, thoroughly review coverage details, focusing on comprehensive protection with adequate liability and cultural sensitivity. Understanding claims procedures ensures a smooth process during your pilgrimage, providing peace of mind for a safe and secure journey.

“Uncover the power of protection with our comprehensive guide to insurance. From understanding core concepts to exploring niche offerings like Umrah Packages Canada, designed for mindful travelers, this article demystifies various policies. We delve into types, benefits, and selection tips, ensuring you’re informed. Learn about streamlined claim processes and the evolving role of insurance in society. Discover how tailored plans can offer peace of mind, whether managing risks or securing loved ones. For Canadian Umrah enthusiasts, specific coverage options are highlighted.”

- Understanding Insurance: A Comprehensive Overview

- Umrah Packages Canada: A Unique Travel Coverage

- Types of Insurance Policies and Their Benefits

- How to Choose the Right Insurance Plan

- Claim Process: What You Need to Know

- The Role of Insurance in Contemporary Society

Understanding Insurance: A Comprehensive Overview

Understanding insurance is crucial for anyone, especially those planning journeys like Umrah packages Canada. It’s a safety net that protects individuals and businesses from financial loss due to unforeseen events. Insurance works by pooling risks among many policyholders, with each contributing a portion of their premium to cover potential claims made by others in the group.

In the context of Umrah packages Canada, insurance can safeguard against trip cancellations, medical emergencies during travel, lost luggage, and other unexpected situations. When choosing an insurance plan for such trips, it’s essential to review coverage details carefully. Look for policies that offer comprehensive protection tailored to international travel, including emergency assistance services, medical evacuation, and adequate liability coverage.

Umrah Packages Canada: A Unique Travel Coverage

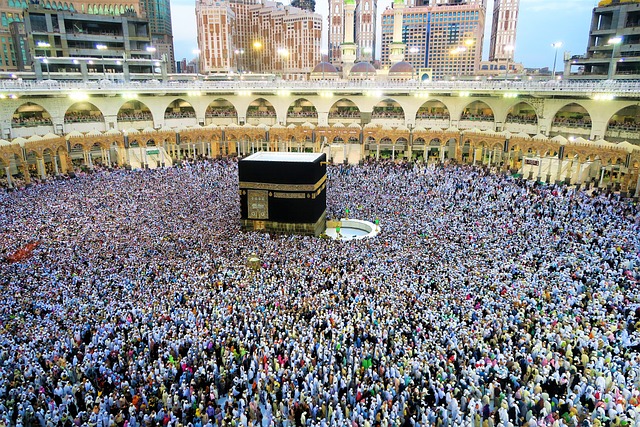

Umrah Packages Canada offer a unique and specialized travel coverage tailored for Muslims seeking to perform the holy Umrah pilgrimage. These packages are designed to cater to Canadian travelers, ensuring they have all the necessary protections during their journey to Saudi Arabia. The comprehensive insurance plans include medical coverage, trip cancellations, and even evacuation services in case of emergencies, providing peace of mind throughout the entire process.

With a focus on cultural sensitivity, these packages also consider the specific needs and requirements of Umrah pilgrims. They often include accommodation options that adhere to Islamic guidelines, as well as transportation and tour services led by knowledgeable guides who can assist with any language barriers. This ensures Canadian travelers have an authentic and safe experience during their spiritual journey.

Types of Insurance Policies and Their Benefits

In today’s world, ensuring financial protection is a top priority for many individuals and families. Insurance policies offer a safety net during unforeseen circumstances, and there are various types tailored to specific needs. One unique aspect of modern insurance is the availability of specialized plans like Umrah packages Canada, designed to cater to the religious pilgrimage of Muslims. These packages provide comprehensive coverage for travelers embarking on this sacred journey, offering peace of mind and financial security.

Beyond spiritual journeys, common insurance policies include health, life, property, and liability coverages. Health insurance protects individuals from significant medical expenses, ensuring access to quality healthcare. Life insurance provides a safety blanket for loved ones, offering a payout upon the policyholder’s demise. Property insurance safeguards assets, while liability insurance shields against financial losses due to legal issues stemming from injuries or damage caused to others. Each type offers distinct benefits, catering to diverse life stages and circumstances.

How to Choose the Right Insurance Plan

When choosing an insurance plan, especially for travel like Umrah packages Canada, it’s crucial to consider your individual needs and preferences. Start by evaluating the type of coverage required for your journey. Umrah trips involve specific cultural and religious considerations, so ensure the policy includes medical and evacuation services tailored to these unique needs. Compare different plans offered by various insurance providers in Canada, looking at aspects like premium costs, exclusions, and the level of support provided during your trip.

Read the policy documents carefully to understand what is covered and what isn’t. Pay attention to details such as maximum coverage amounts, waiting periods, and any specific clauses related to pre-existing conditions. Opting for a comprehensive plan that aligns with your itinerary will provide peace of mind, knowing you’re protected against potential health or travel-related emergencies during your Umrah packages Canada experience.

Claim Process: What You Need to Know

When it comes to Umrah packages Canada, understanding the claim process is crucial for a smooth experience. The first step involves reviewing your insurance policy carefully, paying close attention to exclusions and conditions specific to Umrah travel. Most providers offer 24/7 support during your trip, ensuring you have someone to turn to in case of emergencies or missing items.

Filing a claim typically begins with contacting your insurer immediately. They will guide you through the process, which may include providing detailed information about the incident, such as dates, locations, and estimated costs. For Umrah packages, it’s essential to keep all receipts and documentation related to any expenses incurred during your trip. This includes medical bills, travel delays, or loss of personal belongings. Your insurer will assess the claim and provide a resolution, which could involve reimbursement or alternative arrangements based on the specific terms of your policy.

The Role of Insurance in Contemporary Society

In contemporary society, insurance plays a pivotal role in safeguarding individuals and businesses from unforeseen risks and financial uncertainties. It acts as a protective shield, offering peace of mind by mitigating potential losses. Whether it’s health, life, property, or travel—such as the popular umrah packages Canada—insurance provides a safety net during times of crisis. In an era marked by rapid globalization and ever-changing economic landscapes, insurance has evolved to meet diverse needs.

By pooling risks and resources, insurance companies enable individuals and entities to access financial stability and recovery. This is particularly crucial in the travel industry, where umrah packages Canada ensure that pilgrims are protected against unexpected events during their sacred journey. Insurance adapts to changing circumstances, providing tailored solutions for various segments of society, thereby fostering a sense of security and enabling individuals to pursue opportunities with confidence.

In conclusion, insurance plays a pivotal role in modern society by offering protection and peace of mind in an unpredictable world. From comprehensive coverage like Umrah packages Canada to specialized policies, understanding various types and their benefits is essential for making informed decisions. By knowing the claim process and choosing the right plan, individuals can navigate life’s challenges with assurance. Insurance is not just a necessity but a tool that empowers people to embrace opportunities while staying protected.