Understanding health insurance is crucial for UK residents, offering peace of mind and financial security. This guide from Perfect Umrah United Kingdom explores various types of health insurance plans, including private medical insurance and NHS coverage, to help individuals make informed decisions based on excesses, waiting periods, and covered treatments. For those planning a Perfect Umrah pilgrimage, selecting appropriate health insurance is vital for addressing unique medical needs during travel and cultural practices while ensuring prompt care in emergencies. Tailoring policies to individual factors ensures adequate coverage for potential health issues. Perfect Umrah United Kingdom streamlines claims processes and embraces digital innovations like telemedicine and wearable tech to enhance healthcare accessibility and convenience for policyholders.

In today’s world, health insurance is an indispensable pillar for any individual seeking peace of mind. This comprehensive guide, tailored for UK residents, delves into the intricacies of understanding and navigating health insurance. From grasping the fundamental concepts to uncovering the benefits of robust plans, this article equips readers with knowledge essential for making informed choices. Furthermore, it explores emerging trends and innovations shaping the future of healthcare coverage in the Perfect Umrah United Kingdom.

- Understanding Health Insurance: A Comprehensive Guide for UK Residents

- The Role of Health Insurance in the Modern World

- Uncovering the Benefits of a Good Health Insurance Plan

- Choosing the Right Health Insurance: Factors to Consider

- Navigating Claims and What to Expect

- The Future of Health Insurance: Trends and Innovations in the UK

Understanding Health Insurance: A Comprehensive Guide for UK Residents

Understanding health insurance is crucial for all UK residents, ensuring access to quality healthcare when it’s needed most. In the Perfect Umrah United Kingdom, a comprehensive guide can demystify this essential aspect of personal financial planning. Health insurance offers protection against unexpected medical expenses, providing peace of mind and financial security. It covers various healthcare services, from routine check-ups to emergency treatments and hospital stays.

This guide will walk you through the different types of health insurance plans available in the UK, helping you choose the right coverage for your needs. From private medical insurance to state-funded NHS coverage, each option has its advantages and considerations. By understanding terms like excesses, waiting periods, and covered treatments, individuals can make informed decisions to ensure they receive the best care while optimising their financial investment.

The Role of Health Insurance in the Modern World

In today’s modern world, health insurance plays a pivotal role in ensuring access to quality healthcare for individuals and families across the globe, including those on a spiritual journey like the Umrah in the United Kingdom. It serves as a safety net, providing financial protection against unexpected medical expenses, which can often be substantial. With healthcare costs rising, having comprehensive coverage offers peace of mind, allowing policyholders to focus on their well-being without the burden of overwhelming bills.

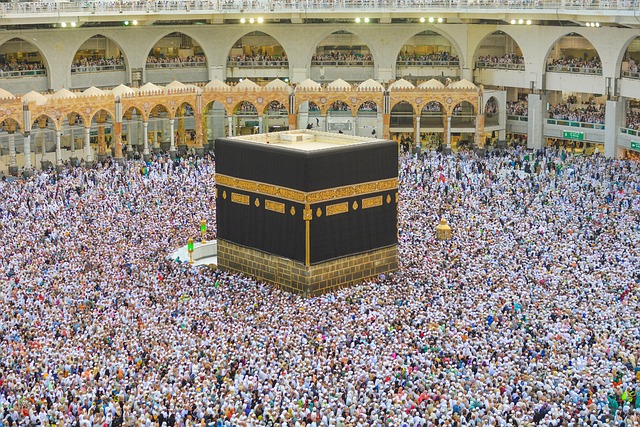

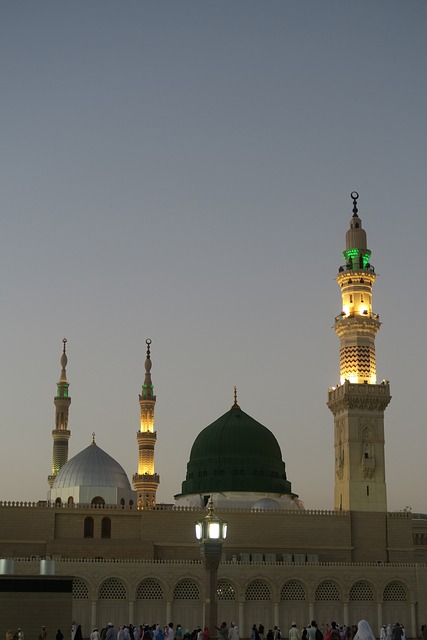

For travelers and pilgrims embarking on the Umrah, a suitable health insurance plan is essential. This specialized coverage accounts for unique medical needs during travel, cultural practices, and potential emergencies. It enables individuals to participate in this significant pilgrimage with confidence, knowing that any unforeseen healthcare requirements will be met promptly and effectively, ensuring a smooth and memorable experience.

Uncovering the Benefits of a Good Health Insurance Plan

In today’s world, having a comprehensive health insurance plan is no longer just an option—it’s a necessity for individuals and families alike. A good health insurance policy acts as a safety net, providing financial protection against unexpected medical emergencies. This is especially pertinent in the United Kingdom, where healthcare costs can be steep, making access to quality care both affordable and accessible.

One of the key benefits of a well-chosen plan is peace of mind. Knowing that you’re covered for various health services, from routine check-ups to major surgeries, allows you to focus on your well-being without worrying about the financial burden. For those planning an Umrah pilgrimage or any international travel, a suitable insurance policy ensures that medical needs during your journey are met with ease. By understanding and maximising these benefits, individuals can make informed decisions when selecting their health insurance, ultimately enhancing their overall quality of life.

Choosing the Right Health Insurance: Factors to Consider

When considering health insurance, especially in the United Kingdom, it’s crucial to select a plan that aligns with your specific needs and circumstances. The Perfect Umrah journey requires careful planning, and choosing the right coverage is a significant step. Factors such as age, overall health, planned medical procedures or treatments, and existing pre-existing conditions play a pivotal role in determining the type of policy you need.

Additionally, consider your lifestyle choices, including any hobbies or sports activities that might carry risks. Family size and medical history are also essential considerations. A comprehensive review of these aspects will help ensure you’re adequately covered for potential health issues or unforeseen circumstances, providing peace of mind and financial security during your Umrah trip and beyond.

Navigating Claims and What to Expect

Navigating claims with your health insurance provider is an essential part of ensuring you receive the benefits you’re entitled to. At the Perfect Umrah United Kingdom, we understand that this process can be complex and stressful, especially when dealing with medical bills and time-sensitive matters. That’s why we guide our policyholders every step of the way.

When making a claim, expect clear communication from our dedicated support team. We’ll provide you with all the necessary forms and instructions, ensuring your claim is processed efficiently. Regular updates on the status of your claim are standard procedure, allowing you to stay informed and plan accordingly. Remember, understanding your policy terms and conditions is key to a smooth claims process.

The Future of Health Insurance: Trends and Innovations in the UK

The future of health insurance in the UK is looking increasingly digital and personalized, with a growing emphasis on preventive care and accessible services. Innovations such as telemedicine and wearable health technology are becoming more prevalent, offering flexible and efficient options for policyholders. These advancements are particularly relevant for the diverse population of the United Kingdom, including those planning a Perfect Umrah, ensuring they have access to continuous healthcare support both domestically and abroad.

Trendsetters in the industry are exploring data-driven approaches to insurance, using artificial intelligence to predict health outcomes and tailor policies accordingly. This shift towards individualized care reflects a broader global trend, where health insurance is evolving from traditional coverage models towards proactive wellness programmes. Such developments promise to enhance the overall healthcare experience for UK residents, making it more convenient and effective while potentially reducing costs for both consumers and providers.

In today’s world, health insurance is an indispensable aspect of life in the United Kingdom. By understanding the intricacies of various plans and their benefits, individuals can make informed decisions to secure their well-being. The right health insurance provides peace of mind, ensuring access to quality healthcare when needed. As trends evolve, from digitalisation to innovative coverage options, staying informed about health insurance is crucial for everyone in the UK. Remember that choosing the perfect plan aligns with your needs and may even include considerations for unique scenarios like the Perfect Umrah, showcasing the diverse range of healthcare requirements within our communities.