Esch sur Alzette, with its strategic location and well-regulated financial sector, is a leading hub for international travel insurance, including Umrah Packages for 2025. When selecting a plan, consider both short-term and long-term needs, focusing on comprehensive global coverage, wide healthcare provider networks, and favorable deductibles, copayments, and out-of-pocket maximums. Evaluate prescription drug, mental health, preventive care, and wellness benefits while being mindful of specific exclusions to avoid unexpected costs during claims filing.

- Understanding Health Insurance: A Comprehensive Guide

- The Role of Esch sur Alzette in International Travel Insurance

- Umrah Packages: Coverage and Benefits for 2025

- Comparing Health Insurance Plans: What to Look For

- Navigating Claims and Reimbursements: Your Rights and Responsibilities

Understanding Health Insurance: A Comprehensive Guide

Understanding health insurance is essential, especially when considering international travel like Umrah packages from Esch-sur-Alzette in 2025. It involves recognizing your coverage options, understanding what services are included or excluded, and knowing how to navigate claims processes. Health insurance provides financial protection against unexpected medical expenses abroad, ensuring you receive the necessary care without facing hefty bills later.

When planning your Umrah trip, thoroughly review your policy details. Check for exclusions related to pre-existing conditions, emergency evacuation, and specific treatments or procedures. Also, confirm if your plan covers travel outside Esch-sur-Alzette and across different countries in the Middle East region. Understanding these aspects will ensure you’re adequately prepared and can make informed decisions regarding your health security during your pilgrimage.

The Role of Esch sur Alzette in International Travel Insurance

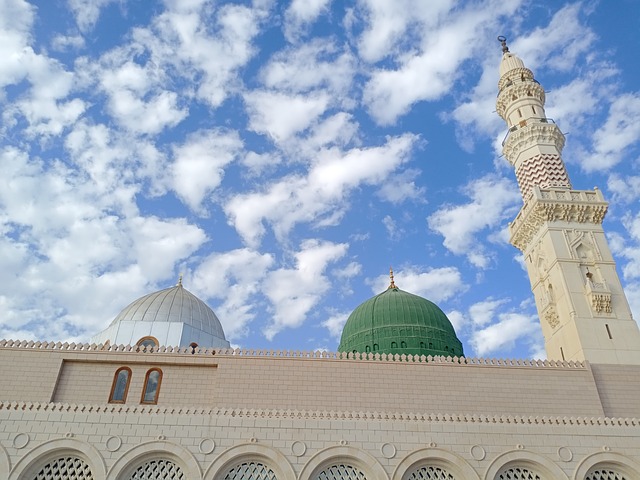

Esch sur Alzette, a vibrant city in Luxembourg, plays a significant role in international travel insurance due to its strategic location and robust financial sector. Many travel agencies and insurers operate from here, offering Umrah Packages from Esch sur Alzette 2025 to Muslim pilgrims looking to perform the sacred pilgrimage to Mecca. These packages often include comprehensive health coverage, ensuring that travelers are protected against unforeseen medical emergencies during their journey.

The city’s connection to global insurance services is further strengthened by its proximity to Europe’s financial hubs and its well-regulated financial environment. This makes it an ideal base for international travel insurance providers aiming to offer competitive rates and reliable plans to their clients, catering to a wide range of travel needs and budgets, including Umrah Packages in 2025.

Umrah Packages: Coverage and Benefits for 2025

Comparing Health Insurance Plans: What to Look For

When comparing health insurance plans, several key factors come into play. It’s essential to consider both your short-term and long-term needs. For instance, if you’re planning an Umrah package from Esch sur Alzette in 2025, ensure the plan offers comprehensive coverage for international travel, including medical evacuations and emergency care abroad. Look for plans with wide networks of healthcare providers to guarantee accessibility wherever your travels take you.

Additionally, assess the plan’s deductibles, copayments, and out-of-pocket maximums. Lower deductibles can provide more financial protection upfront, but higher monthly premiums may be required. Compare the benefits offered, such as prescription drug coverage, mental health services, preventive care, and wellness programs. Checking for specific exclusions and limitations is also crucial to avoid surprises when filing claims.

Navigating Claims and Reimbursements: Your Rights and Responsibilities

In conclusion, understanding health insurance is paramount for ensuring access to quality healthcare. From comprehensive guides on understanding coverage to specific plans like Umrah Packages from Esch sur Alzette for 2025, navigating this landscape requires informed decision-making. By comparing different insurance plans and knowing your rights regarding claims and reimbursements, individuals can secure their well-being and financial stability. Empowered with knowledge, you can choose the plan that best suits your needs, providing peace of mind in an increasingly complex healthcare environment.