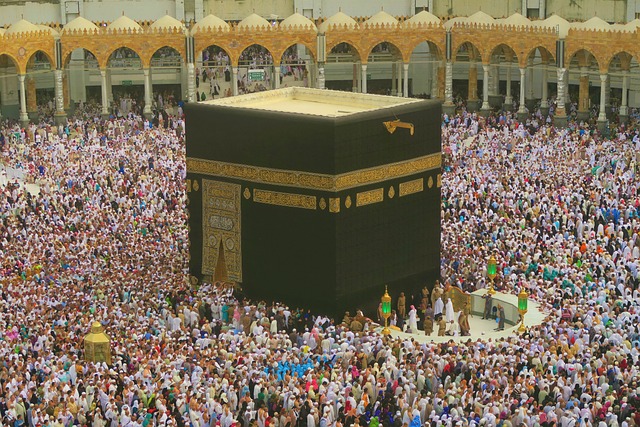

Planning an Umrah pilgrimage from the UK involves understanding the combined expenses of the visa and health insurance. Visa costs vary based on travel dates, tour packages, and individual preferences, while health insurance prices differ according to comprehensive vs. basic plans, trip duration, pre-existing conditions, age, and destination healthcare costs. To budget effectively, compare policies that meet Umrah-specific needs, including emergency medical evacuations, and consider add-ons for international and religious travel. Remember to factor in the cost of the Umrah visa when choosing health insurance.

“Embark on a journey to unravel the intricacies of health insurance, an indispensable aspect of international travel, especially for spiritual retreats like Umrah. This comprehensive guide aims to empower UK residents with knowledge about their options. From understanding policy costs and requirements to maximizing coverage, we delve into essential aspects. Learn how factors influence the price of Umrah visas and discover strategies to navigate the process effectively. By exploring various health insurance plans, you can ensure a smooth and worry-free Umrah experience.”

- Understanding Health Insurance: A Comprehensive Guide

- The Role of Health Insurance in International Travel: A Focus on Umrah Visa from the UK

- Decoding Health Insurance Costs: Factors Affecting Umrah Visa Expenses

- Navigating Umrah Visa Requirements: Essential Documents and Pre-Departure Checklist

- Comparing Health Insurance Plans: Finding the Best Fit for Your Umrah Journey

- Maximizing Your Coverage: Tips to Make the Most of Your Health Insurance During Umrah

Understanding Health Insurance: A Comprehensive Guide

The Role of Health Insurance in International Travel: A Focus on Umrah Visa from the UK

Decoding Health Insurance Costs: Factors Affecting Umrah Visa Expenses

Understanding and decoding health insurance costs is a crucial step in planning for any international trip, including Umrah. When considering how much an Umrah visa from the UK will cost, several factors come into play. Firstly, the level of cover you require will impact the price; comprehensive plans tend to be more expensive but offer broader protection. The duration of your stay is another significant determinant—longer trips usually incur higher fees due to extended medical coverage needs.

Additionally, pre-existing conditions and age can influence visa expenses. Insurance providers may charge extra for individuals with existing health issues or those in older age groups as they carry a higher risk. Travel destination is also critical; certain locations may have varying healthcare costs, which are reflected in the insurance rates. Therefore, when planning your Umrah trip, thoroughly research and compare plans to find the most suitable and affordable health insurance that meets your specific requirements.

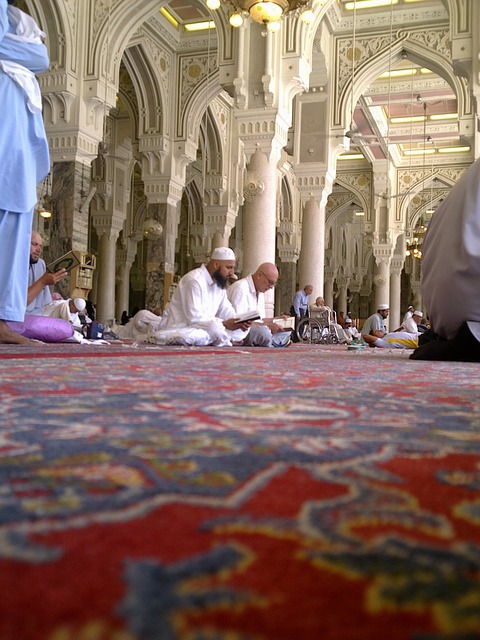

Navigating Umrah Visa Requirements: Essential Documents and Pre-Departure Checklist

Navigating Umrah Visa requirements involves a careful check of essential documents and a thorough pre-departure checklist. For UK residents planning an Umrah, understanding the visa process is crucial. The cost of the Umrah visa from the UK can vary, but it’s essential to gather necessary paperwork early on. This typically includes a valid passport with at least six months’ validity, proof of financial means, and a medical fitness certificate.

A pre-departure checklist should encompass these documents along with travel insurance covering specific Umrah activities, vaccination certificates (if required), and a letter of invitation from the Saudi Arabian host or tour operator. This meticulous approach ensures a smooth visa application process, as many elements are out of your control once you’re in the country. Remember, how much an Umrah visa costs is not solely determined by your nationality, but also by the complexity of your travel arrangements and the service you opt for.

Comparing Health Insurance Plans: Finding the Best Fit for Your Umrah Journey

When planning an Umrah journey, one of the essential considerations is choosing the right health insurance plan. This decision is crucial as it provides peace of mind and ensures access to quality healthcare during your pilgrimage. Comparing different plans is a meticulous process, but it’s vital to find a policy that aligns with your specific needs and budget. Start by evaluating the coverage offered, including inpatient and outpatient care, emergency services, and any additional benefits relevant to Umrah, such as religious accommodations or specialized medical facilities in Saudi Arabia.

Factors like the scope of international coverage, exclusions, and the network of healthcare providers are key elements to scrutinize. Additionally, understanding the financial aspects is imperative; consider the policy’s premium, excess amounts, and how much you might need to pay out of pocket for various services. With the cost of Umrah visas from the UK varying, ensuring your health insurance is tailored to cover these expenses and more will make your journey smoother and less stressful.

Maximizing Your Coverage: Tips to Make the Most of Your Health Insurance During Umrah

When planning an Umrah from the UK, understanding and maximising your health insurance coverage is crucial. While many travel insurance policies offer basic medical coverage, it’s essential to consider whether it aligns with the specific requirements of an Umrah pilgrimage. Ensure your policy covers emergency medical evacuations, which can be particularly important in remote areas during this spiritual journey. Additionally, check for limitations on pre-existing conditions and consider any restrictions on the amount of time you’re covered for – crucial when factoring in the typical duration of an Umrah trip and potential delays.

To make the most of your health insurance during Umrah, compare policies to find one that offers comprehensive coverage at a cost that fits within your budget. Remember that the price of Umrah visas from the UK can vary significantly, so balancing visa expenses with robust health insurance is key. Consider add-ons for specific activities or destinations you plan to visit; some policies offer tailored packages for international travel and religious pilgrimages. This ensures you’re prepared for any unforeseen healthcare needs during your spiritual journey.