- Understanding Health Insurance: A Comprehensive Guide

- Umrah Packages: Navigating Coverage Options in 2025

- Choosing the Right Plan: Factors to Consider for Individuals

- Group Health Insurance: Benefits and Advantages for Organizations

Understanding Health Insurance: A Comprehensive Guide

Umrah Packages: Navigating Coverage Options in 2025

Choosing the Right Plan: Factors to Consider for Individuals

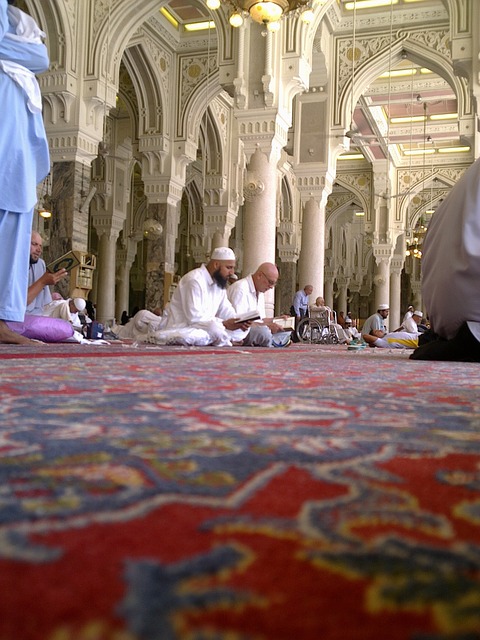

When selecting a health insurance plan, individuals in Portugal, especially those planning for an Umrah pilgrimage in 2025, should consider several key factors to ensure comprehensive coverage. Firstly, assess your medical needs and existing conditions; choose a plan that offers adequate coverage for any pre-existing ailments and includes necessary specialist care options. Secondly, evaluate the network of healthcare providers within your chosen plan’s scope. Accessing quality healthcare facilities during or after your Umrah trip is essential, so ensure your plan provides access to reputable hospitals and clinics in destinations like Mecca and Medina, if relevant.

Additionally, consider out-of-pocket expenses such as deductibles, copayments, and coinsurance percentages. Balancing these costs with the level of coverage is crucial. Umrah packages from Coimbra 2025 may require specific coverage for travel-related incidents or medical emergencies in foreign lands. Compare plans offering international travel insurance to ensure you’re protected during your pilgrimage, considering both the duration and scope of coverage.

Group Health Insurance: Benefits and Advantages for Organizations

Group health insurance is a powerful tool for organizations aiming to enhance their employee benefits package, especially when considering Umrah Packages from Coimbra in 2025. This type of insurance provides a range of advantages that can significantly improve overall staff satisfaction and retention. By offering group coverage, companies can negotiate better rates with insurance providers, making health care more affordable for both employees and employers. This cost-effectiveness is particularly beneficial for smaller businesses that might struggle to offer individual plans.

Moreover, group health insurance allows for a broader range of benefits, including access to comprehensive medical networks, preventive care services, and sometimes even wellness programs. This can lead to healthier employees and reduced long-term healthcare costs. When organizations prioritize their workers’ well-being through such initiatives, it fosters a positive company culture and enhances employee loyalty, which is invaluable in today’s competitive business landscape.

Health insurance is a vital tool for navigating the complex landscape of healthcare. Whether you’re an individual seeking tailored plans or an organization aiming to provide comprehensive group coverage, understanding your options is key. In 2025, Umrah Packages from Coimbra offer unique coverage opportunities, allowing travelers and pilgrims alike to focus on their well-being with peace of mind. By exploring various plan factors, from benefits to costs, you can make informed decisions that suit your specific needs, ensuring access to quality healthcare when and where it’s needed most.