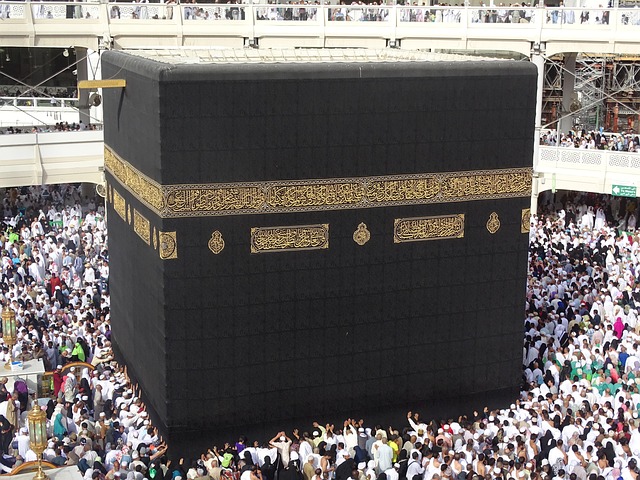

For a seamless and secure perfect Umrah Lahore trip, travel insurance is essential protection against unforeseen events like medical emergencies, flight delays, or lost belongings. With various plans available, tailor your coverage based on trip duration, health, and activities, focusing on comprehensive medical, cancellation, and loss protection. Avoid financial surprises by understanding policy exclusions, especially for extreme sports or pre-existing conditions. For claims, review your policy, gather documents, and contact your insurer promptly. Ensure a worry-free Umrah Lahore experience with insurance from reputable providers specializing in religious travel, offering 24/7 support and tailored coverage for a rich pilgrimage.

Embark on your perfect Umrah Lahore journey with the peace of mind that comes from proper travel insurance. Understanding this crucial coverage is essential for navigating unforeseen challenges and ensuring a smooth, memorable trip. This comprehensive guide breaks down everything you need to know about travel insurance, from choosing the right plan to understanding what’s covered and how to make a claim. We’ll also share expert tips for selecting a reliable provider tailored to your Umrah needs.

- Understanding Travel Insurance: Why It's Essential for Your Perfect Umrah Lahore Journey

- Types of Travel Insurance Plans: Choosing the Right Coverage for Your Needs

- What Is Included in a Standard Travel Insurance Policy?

- Exclusions and Limitations: Things Not Covered by Your Travel Insurance

- How to Claim Under Your Travel Insurance: A Step-by-Step Guide

- Tips for Selecting a Reliable Travel Insurance Provider for Your Umrah Trip

Understanding Travel Insurance: Why It's Essential for Your Perfect Umrah Lahore Journey

Travel insurance is an invaluable tool for anyone planning a journey, especially a significant one like Umrah in Lahore. It provides peace of mind and financial protection against unforeseen circumstances that may arise during your trip. When embarking on a perfect Umrah Lahore journey, you’ll encounter various activities, from exploring historical sites to engaging in spiritual practices. However, unexpected events like medical emergencies, flight delays, or loss of belongings can disrupt even the best-laid plans.

Travel insurance covers these potential issues, ensuring you’re not left stranded financially. It offers peace of mind, allowing you to focus on enjoying your perfect Umrah Lahore experience without worrying about the financial implications of unexpected events. With its comprehensive coverage, you’ll be protected during every stage of your journey, from pre-trip cancellations to medical emergencies while in Lahore.

Types of Travel Insurance Plans: Choosing the Right Coverage for Your Needs

When considering travel insurance, it’s crucial to understand that not all plans are created equal. The market offers a wide array of options, each tailored to different types of travelers and specific destinations, like the perfect Umrah Lahore experience. From basic coverage for medical emergencies to comprehensive plans that include trip cancellations, lost luggage, and even adventure sports, understanding these variations is key to choosing the right fit.

Factors such as the length and nature of your trip, your health status, and intended activities greatly influence what type of insurance you need. For instance, a religious pilgrimage like Umrah in Lahore might require additional coverage for specific medical conditions or evacuation services within the region. By carefully evaluating your needs, you can select a plan that offers peace of mind and adequate protection during your travels.

What Is Included in a Standard Travel Insurance Policy?

A standard travel insurance policy typically covers a wide range of unforeseen events and expenses that may arise during your travels, offering peace of mind for any Perfect Umrah Lahore or international trip. The scope of coverage varies among providers, but here are some common elements included in such policies:

Medical emergencies are a primary concern, ensuring access to quality healthcare and hospitalization costs if needed. Trip cancellations or interruptions due to unforeseen circumstances, such as illness or natural disasters, are also usually covered, providing financial protection for non-refundable expenses. Travel insurance often includes baggage loss or delay coverage, which can compensate for missing or delayed luggage, containing essential items like medications or travel documents. Additionally, some policies offer protection against trip delays caused by travel disruptions, providing alternative arrangements and meals during unforeseen delays.

Exclusions and Limitations: Things Not Covered by Your Travel Insurance

Travel insurance is designed to protect you from unforeseen events while on your journey, but it’s crucial to understand what’s covered and what isn’t. Many policies have exclusions and limitations that travelers often overlook. For instance, certain activities like extreme sports or adventure travel may not be included in standard plans. Health conditions pre-existing before the trip are also commonly excluded. When planning a perfect Umrah Lahore or any international voyage, it’s essential to read the policy details carefully.

Some policies might not cover emergency medical evacuations or repatriation, and there could be limits on the amount of financial protection offered for lost luggage or canceled trips. Certain types of travel, like long-term stays or multiple destinations, may require specific add-ons to ensure comprehensive coverage. Understanding these exclusions is vital to avoid unexpected financial burdens during your travels.

How to Claim Under Your Travel Insurance: A Step-by-Step Guide

How to Claim Under Your Travel Insurance: A Step-by-Step Guide

The first step in claiming under your travel insurance is to review your policy documents carefully. Understand what is covered and the specific conditions attached to each type of coverage, especially when planning a perfect Umrah Lahore trip. Ensure you have all necessary paperwork, including your travel itinerary, medical records, and any other documents required by your insurance provider.

Once you’ve confirmed your eligibility for a claim, initiate the process by contacting your insurance provider’s customer service. They will guide you through the next steps, which typically involve filling out a claim form, providing detailed information about your incident, and submitting supporting documents. Keep records of all communications and documentation for future reference. Remember, prompt action is crucial, as most policies have time limits for filing claims.

Tips for Selecting a Reliable Travel Insurance Provider for Your Umrah Trip

When choosing a travel insurance provider for your Umrah trip, it’s crucial to consider their reliability and ability to cater to your specific needs. Look for companies with strong reputations and extensive experience in facilitating umrah journeys. Research their customer reviews and feedback to gauge their service quality. A perfect Umrah Lahore experience requires an insurer who understands the unique requirements of this pilgrimage, offering comprehensive coverage that includes medical emergencies, trip cancellations, and lost baggage.

Ensure the policy provides adequate protection for your entire itinerary, including any cultural or religious activities you plan to participate in. Compare different plans and their inclusions carefully. Consider providers who offer 24/7 customer support, ensuring you have assistance whenever needed during your travel. A reliable insurer will also guide you through any visa requirements and ensure compliance with local regulations, allowing you to focus on making memorable experiences during your Umrah trip.

Travel insurance is an indispensable companion for your perfect Umrah Lahore journey, offering peace of mind and financial protection against unforeseen events. By understanding the various types of plans, their inclusions, and exclusions, you can choose the right coverage tailored to your needs. When selecting a provider, ensure they are reliable and trustworthy, allowing you to focus on making unforgettable memories in this vibrant city without worrying about potential risks.