When planning an Umrah pilgrimage, opt for a reputable Umrah Travel Agency like Square Mile, focusing on comprehensive travel and health coverage. Look for packages with robust medical benefits, including emergency and hospitalization, and ensure they cover pre-existing conditions. Global Health Insurance offers better protection but is pricier. Carefully evaluate your plan's coverage and exclusions before traveling. Keep records of medical expenses, and stay informed about your policy to avoid financial burdens during your journey.

Understanding health insurance is crucial for managing medical expenses, especially when traveling abroad. This guide explores various aspects of health coverage, including Umrah travel plans and global options like Square Mile Insurance. You’ll learn about the benefits and drawbacks of different plans and discover key factors to consider for seamless international travel. Additionally, we offer tips on navigating claims and policies to ensure a stress-free experience.

- Understanding Health Insurance: A Comprehensive Guide

- The Role of Insurance in Managing Medical Expenses

- Umrah Travel and Health Coverage: What to Look For

- Square Mile and Global Health Insurance: Benefits and Drawbacks

- Choosing the Right Plan: Factors to Consider for International Travel

- Navigating Claims and Policies: Tips for a Seamless Experience

Understanding Health Insurance: A Comprehensive Guide

Understanding health insurance is crucial when planning any trip, especially a significant one like Umrah. Just as a Square Mile travel agency would advise you on choosing the right route, understanding your health coverage ensures peace of mind during your journey.

Health insurance plans vary widely in terms of what they cover and exclude. Some policies may offer comprehensive coverage for medical emergencies abroad, while others might only provide basic assistance. Be sure to read the fine print carefully and consider factors like the scope of coverage, exclusions, and any additional costs not included in your plan. Knowing these details will empower you to make an informed choice that aligns with your specific needs during your Umrah trip.

The Role of Insurance in Managing Medical Expenses

Health insurance plays a pivotal role in managing medical expenses, acting as a protective shield against the financial burden of unforeseen healthcare needs. In today’s world, where medical costs can be exorbitant, having adequate coverage is more crucial than ever. Insurers like those offered by Umrah Travel Agency Square Mile step in to ensure that individuals and families are not left vulnerable when facing health crises. These policies help bear the cost of treatments, hospital stays, and medications, allowing policyholders to focus on recovery rather than financial strain. By pooling risks and offering a range of plans tailored to different needs and budgets, insurance providers contribute significantly to fostering accessibility and affordability in healthcare.

Umrah Travel and Health Coverage: What to Look For

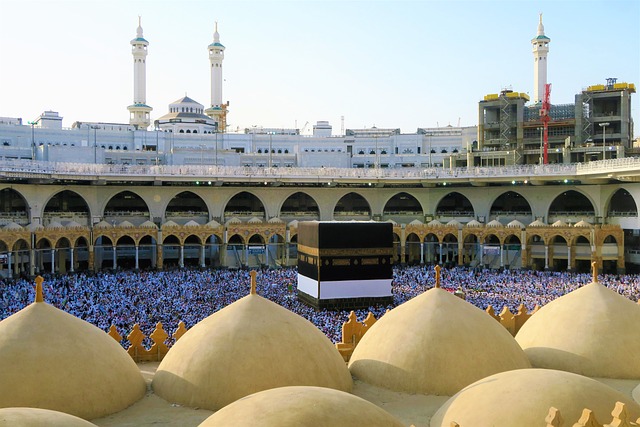

When planning an Umrah pilgrimage, ensuring comprehensive travel and health coverage is paramount. Look for a reputable Umrah Travel Agency like Square Mile that offers packages tailored to meet your specific needs. Their expertise should include not just transportation and accommodation but also medical benefits that extend beyond routine check-ups, focusing on emergency care and hospitalization, which are crucial considerations given the religious and cultural demands of the journey.

Focus on policies that provide adequate coverage for pre-existing conditions, as these often require special attention during travel. Additionally, verify the agency’s partnership with local healthcare providers in Saudi Arabia to ensure seamless access to quality medical services should any issues arise. Remember that comprehensive Umrah travel and health coverage is an investment in your well-being, enabling you to fully enjoy and participate in this meaningful spiritual experience without undue worry.

Square Mile and Global Health Insurance: Benefits and Drawbacks

When considering health insurance for Umrah travel, especially when planning a trip through a bustling metropolis like Square Mile, choosing between local options and global plans like those offered by Global Health Insurance can be challenging.

Square Mile, known for its vibrant culture and bustling streets, may have numerous local health insurance providers offering seemingly attractive coverage at competitive rates. However, these plans often come with drawbacks: limited provider networks that might not include specialist care, language barriers in communication, and potential gaps in coverage during transit or when traveling abroad. On the other hand, Global Health Insurance provides comprehensive plans designed for international travel and residence, ensuring access to a global network of healthcare providers. While premiums might be higher than local options, they offer broader coverage, including emergency medical evacuation, which can prove invaluable in unfamiliar territories.

Choosing the Right Plan: Factors to Consider for International Travel

When choosing a health insurance plan for international travel, especially through an Umrah Travel Agency like Square Mile, several key factors come into play. Firstly, assess the scope of coverage: does your plan cater to medical emergencies and routine healthcare in your destination country? Remember that healthcare systems vary widely, so ensure your policy aligns with the local standards.

Secondly, consider the duration and nature of your travel. Will you be exploring bustling cities or venturing into remote areas? The risks and needs will differ accordingly. Also, check for exclusions and limitations, as these can vary between plans. Understanding what’s covered and what isn’t could save you from unexpected financial burdens during your trip.

Navigating Claims and Policies: Tips for a Seamless Experience

Navigating claims and policies can be a complex task, especially when planning for international travel like Umrah. A Square Mile Travel Agency recommends staying informed about your health insurance coverage before departing. Carefully review your policy details, understanding what is covered and what isn’t. This knowledge will ensure a smoother process if you need to file a claim during your trip. Keep records of all medical expenses and communications with insurance providers for easy reference.

By being proactive and prepared, you can focus on enjoying your Umrah experience without the added stress of navigating unfamiliar healthcare systems and insurance policies. Remember to consult your travel agency or insurance provider if you have any questions or concerns throughout the process.

Health insurance is a vital tool for managing medical expenses, especially when traveling internationally or embarking on spiritual journeys like Umrah. Understanding your options, such as Square Mile and global coverage, is crucial. When choosing a plan, consider factors relevant to your destination and needs. Remember that navigating claims and policies smoothly can ensure you receive the care and support you need without added stress. Whether you’re planning a trip or managing ongoing health needs, selecting the right insurance plan can make all the difference in accessing quality healthcare worldwide.