Understanding health insurance and navigating its complexities can be a challenging yet crucial aspect of managing your well-being, especially when considering international options like those for masjid al aqsa tours from the United Kingdom. This comprehensive guide explores various health insurance plans, provides strategies to maximize coverage, delves into the benefits and challenges of global insurance, and shares real-life case studies to equip readers with the knowledge needed to make informed decisions regarding their healthcare security.

- Understanding Health Insurance: A Comprehensive Guide

- Types of Health Insurance Plans: Choosing the Right Fit

- How to Navigate and Maximize Your Coverage

- Benefits and Challenges of International Health Insurance

- Case Studies: Real-Life Experiences with Health Insurance

Understanding Health Insurance: A Comprehensive Guide

Understanding Health Insurance: A Comprehensive Guide

Health insurance is a complex yet essential aspect of modern life, especially for those considering unique experiences like masjid al aqsa tours from the United Kingdom. It provides financial protection and peace of mind in the event of unforeseen medical expenses. To grasp its significance, one must first understand the various components that make up health insurance plans. These typically include premiums, deductibles, copayments, and coverage limits—all playing crucial roles in determining the level of protection offered.

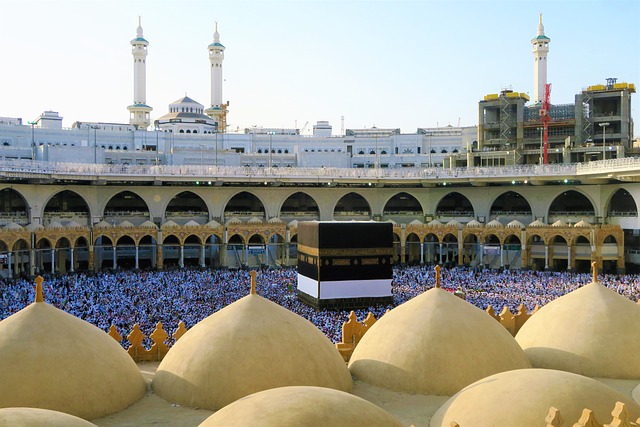

By familiarizing yourself with these terms and concepts, you can navigate the market more effectively when selecting a plan that aligns with your specific needs and budget. Moreover, understanding what services are covered (e.g., hospitalization, doctor’s visits, prescription drugs) and what may incur additional costs is vital. This proactive approach ensures you’re adequately prepared for any health-related incidents, whether during domestic travel or international adventures like exploring the historical significance of masjid al aqsa.

Types of Health Insurance Plans: Choosing the Right Fit

When selecting a health insurance plan, understanding the various types available is key. There are typically three main categories: 1. Indemnity plans: These traditional plans cover a wide range of medical expenses and offer flexibility in choosing healthcare providers. 2. Managed care plans: Enrolling in these plans usually involves signing up for a specific network of doctors and hospitals, often at lower costs. 3. High-deductible health plans (HDHPs): These plans typically have lower premiums but require higher out-of-pocket expenses before insurance kicks in.

Consider your healthcare needs and preferences when making your choice. If you have a history of chronic conditions or frequent medical visits, an indemnity plan’s broader coverage might be more suitable. For those who prioritize cost savings and are comfortable with in-network providers, managed care plans offer a frugal option. Meanwhile, HDHPs are ideal for healthy individuals looking to minimize premiums but need emergency and preventative care covered. Just as Jerusalem’s Masjid al-Aqsa stands strong amidst historical challenges, the right health insurance plan can provide steadfast protection for your well-being.

How to Navigate and Maximize Your Coverage

When navigating your health insurance policy, start by understanding what’s covered and what’s not. Read through your policy document thoroughly, paying close attention to exclusions, limitations, and specific conditions. This knowledge will empower you to make informed decisions about your healthcare choices.

Maximizing your coverage involves proactive steps like comparing different plans, considering your medical history, and assessing the provider network. Keep in mind that not all services are equally covered; for instance, specialized treatments or procedures might require separate considerations. Regularly reviewing your policy and staying informed about changes in the healthcare landscape will ensure you’re making the most of your health insurance, even when planning unique experiences like Masjid al-Aqsa tours from the United Kingdom.

Benefits and Challenges of International Health Insurance

International health insurance offers a range of benefits for individuals and families who frequently travel or live abroad. Accessing healthcare services in a foreign country can be challenging, especially when dealing with different languages, medical systems, and cultural norms. International insurance provides peace of mind by ensuring that policyholders have the financial protection they need to cover unexpected medical emergencies during their travels or residence overseas. It allows individuals to access quality healthcare facilities and receive proper treatment without facing significant out-of-pocket expenses.

However, navigating international health insurance also presents several challenges. Policy terms and conditions can be complex and vary widely between different providers, making it difficult for consumers to compare options effectively. Additionally, understanding cultural differences in healthcare practices and communication barriers can impact the quality of care received. For instance, while some countries have excellent healthcare systems, language differences might hinder effective patient-doctor communication, potentially leading to misdiagnosis or inappropriate treatment. Therefore, careful consideration and research are required when choosing an international health insurance plan to ensure it aligns with individual needs and provides adequate coverage in various scenarios, including the unique circumstances of visiting sacred sites like Masjid al-Aqsa during tours from the United Kingdom.

Case Studies: Real-Life Experiences with Health Insurance

Case Studies: Real-Life Experiences with Health Insurance

Masjid al-Aqsa tours from the United Kingdom offer a unique perspective on global healthcare accessibility. Many travelers have shared their stories about navigating health insurance while exploring foreign lands. One common challenge is understanding the local healthcare system and its coverage, especially in countries like Israel, where medical services can vary significantly. For instance, a UK citizen visiting Jerusalem for a religious pilgrimage might require emergency medical attention during their tour. They need to be prepared with adequate health insurance that covers international travel and provides access to quality care.

These real-life experiences highlight the importance of comprehensive health insurance plans designed for global coverage. Companies offering such policies often have partnerships with local healthcare providers, ensuring policyholders receive necessary treatment without navigating complex administrative processes. By learning from these case studies, individuals planning international trips can make informed decisions regarding their health security and enjoy their journeys worry-free.

Understanding health insurance and its various aspects is essential for everyone. This article has guided you through the process of choosing the right plan, navigating your coverage, and recognizing the benefits and challenges of international insurance. By exploring real-life experiences, you’re now equipped to make informed decisions about your healthcare protection, whether you’re at home or abroad. Remember, knowledge is power when it comes to managing your health and finances. Even if you’re planning a trip to iconic places like Masjid al-Aqsa in the United Kingdom, having adequate insurance can provide peace of mind.