Insurance is crucial for securing your future plans, like Umrah in 2025, offering financial protection against unforeseen events. When planning this significant trip, understand different insurance types, their benefits, and drawbacks. Compare policies, focusing on comprehensive coverage for international travel risks. Choose a plan aligned with your itinerary and health needs. In 2025, technology like blockchain and AI will revolutionize the industry, making insurance more accessible and tailored to individual trips, including Umrah. For claims, promptly notify your insurer, document all info, and follow their procedures for a swift settlement.

Insurance is a vital pillar in managing uncertainty and securing your future. In today’s dynamic world, from travel plans to daily life, understanding insurance coverage is essential for peace of mind. This comprehensive guide explores various aspects of insurance, including its role in travel, different policy types, and how to choose the best fit. We also delve into claiming processes and glimpse into emerging trends shaping the industry, such as the potential impact of tickets to Umrah 2025 on insurance landscapes.

- Understanding Insurance: A Comprehensive Guide

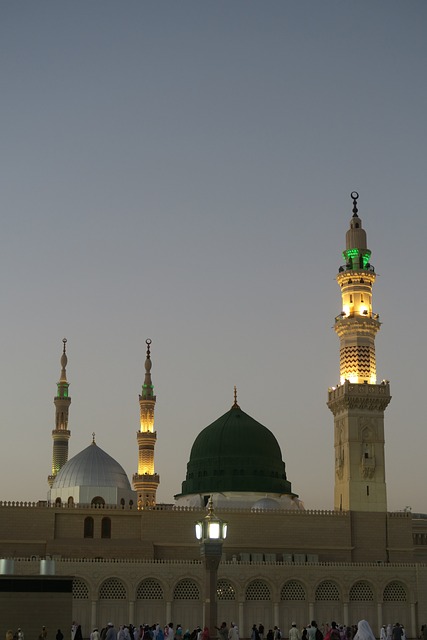

- The Role of Insurance in Your Travel Plans: Tickets to Umrah 2025

- Types of Insurance Policies Available

- How to Choose the Right Insurance Coverage

- Claiming Insurance: A Step-by-Step Process

- The Future of Insurance: Emerging Trends and Technologies

Understanding Insurance: A Comprehensive Guide

Insurance is a safety net that protects individuals and businesses from financial losses due to unforeseen events. When you purchase an insurance policy, you’re essentially pooling risks with other policyholders. In return for regular premiums, an insurance company agrees to cover specific expenses or losses outlined in your policy if they occur. This includes everything from health emergencies and car accidents to natural disasters and business interruptions.

When planning for future events like tickets to umrah 2025, understanding insurance becomes crucial. A comprehensive guide should demystify various types of coverage, their benefits, and potential drawbacks. By reviewing policy terms, comparing different plans, and assessing your individual or business needs, you can make informed decisions to ensure adequate protection against unexpected risks.

The Role of Insurance in Your Travel Plans: Tickets to Umrah 2025

Insurance plays a pivotal role in ensuring your travel plans, especially for significant journeys like Umrah in 2025, go smoothly and without unexpected financial strain. When securing tickets to Umrah 2025, it’s not just about booking your trip; it’s also about safeguarding yourself against unforeseen events that could disrupt or even cancel your pilgrimage. Travel insurance provides peace of mind by covering medical emergencies, trip cancellations, lost luggage, and other potential issues.

Having the right insurance means you’re prepared for any challenges that may arise during your sacred journey. It allows you to focus on the spiritual experience rather than worrying about financial implications. Make sure to review the policy details carefully, ensuring it covers all aspects of your Umrah trip, from transportation and accommodation to medical care and personal liability. With proper insurance in place, tickets to Umrah 2025 become a step towards a worry-free and memorable pilgrimage.

Types of Insurance Policies Available

When considering insurance options, it’s essential to understand the diverse range of policies on offer. One such area of interest for many individuals is travel insurance, particularly when planning significant trips like Umrah in 2025. Tickets to Umrah 2025 often come with their own set of risks and uncertainties, from health issues to trip cancellations or delays. Therefore, comprehensive travel insurance packages cater specifically to these concerns, providing financial protection for unexpected events during your journey.

Within the umbrella of travel insurance, various types are available to suit different needs. For instance, medical travel insurance focuses on covering healthcare expenses abroad, which can be particularly crucial in ensuring accessibility to quality care during your Umrah trip. Additionally, cancellation and interruption insurance safeguard against unforeseen circumstances that may disrupt or cancel your travel plans, offering refunds or alternative arrangements. Exploring these options ensures you’re prepared for any eventuality while enjoying a seamless experience during your religious pilgrimage.

How to Choose the Right Insurance Coverage

When selecting insurance, especially for a significant event like Umrah in 2025, understanding your needs is crucial. Start by researching and comparing different policies, focusing on what’s covered and the level of protection offered. Look for comprehensive plans that cater to specific risks associated with international travel, such as medical emergencies, trip cancellations, or lost/stolen luggage—including any unique considerations like tickets to Umrah 2025.

Consider your itinerary, duration of stay, health conditions (if any), and the overall cost of the trip when choosing a policy. Don’t hesitate to read the fine print; clarify terms and exclusions with providers to ensure you’re adequately protected throughout your journey.

Claiming Insurance: A Step-by-Step Process

Claiming insurance for your tickets to Umrah 2025 or any other travel plans is a straightforward process, but it’s crucial to follow the right steps to ensure a smooth experience. Here’s a step-by-step guide to help you navigate the claims procedure:

1. Review Your Policy: Start by thoroughly reading and understanding your insurance policy. Check what is covered under your plan, including any specific exclusions. Make a note of the contact information of your insurance provider for easy access later.

2. Document Everything: In case of an event that requires an insurance claim—like trip cancellations or interruptions due to unforeseen circumstances—gather all necessary documents. This includes receipts, tickets (such as tickets to Umrah 2025), medical reports, police reports (if applicable), and any other evidence related to your claim.

3. Notify Your Insurer: Contact your insurance provider as soon as possible to inform them about your intention to file a claim. Provide them with the details of your policy, the nature of the incident, and the estimated costs. They will guide you through the next steps and may require some initial information from you.

4. Fill Out the Claim Form: Obtain the claim form from your insurer or download it from their website. Fill it out accurately and completely, ensuring all relevant details are included. Attach any supporting documents mentioned in the form. Return this form to the insurer as instructed.

5. Wait for Assessment: Once submitted, your claim will be assessed by the insurance company. They will verify the information provided and validate the eligibility of your claim based on the policy terms. This process may take some time, so be patient.

6. Settlement and Payment: If your claim is approved, the insurer will provide you with the payment details or settle the claim directly with the service provider (e.g., travel agent) on your behalf. Ensure you keep records of all communications and documents related to the claims process for future reference.

The Future of Insurance: Emerging Trends and Technologies

The insurance industry is on the cusp of a significant transformation, driven by technological advancements and evolving consumer needs. One notable trend is the integration of smart contracts and blockchain technology, promising greater efficiency and transparency in claims processing. This shift could lead to quicker settlement times for tickets to umrah 2025 or other travel insurance claims, enhancing customer satisfaction.

Artificial intelligence (AI) and machine learning algorithms are also set to play a pivotal role. These technologies enable insurers to analyze vast datasets, predict risks more accurately, and tailor policies to individual customers’ profiles. From personalized pricing models to proactive risk management, AI-driven solutions are set to reshape the industry in 2025 and beyond, making insurance coverage more accessible, affordable, and relevant for all.

In conclusion, insurance is an indispensable tool for managing risks and securing financial peace of mind, whether you’re planning a journey like Umrah in 2025 or aiming to protect your assets. Understanding different policy types and choosing the right coverage is key. By familiarizing yourself with the claims process and staying abreast of emerging trends like digital policies, you can navigate the insurance landscape with confidence. Remember, having the right insurance isn’t just about prevention; it’s about gaining peace of mind and ensuring a smoother future, especially when embarking on meaningful trips like Umrah.