In a dynamic world, insurance is crucial for mitigating risks associated with unforeseen events, especially complex ventures like Hajj Packages 2025 from Japan. Comprehensive coverage offers peace of mind, protecting against health issues, property damage, and liability during international travel. Japan's role in enhancing safety protocols for the 2025 Hajj includes advanced technology, medical facilities, and emergency response systems. Specialized insurance packages cater to pilgrims' unique needs, providing trip cancellations, medical emergencies, and evacuation services. Navigating claims requires understanding policy conditions, timely communication with providers, and maintaining accurate records. Technological advancements, such as AI and digital platforms, revolutionize the industry by improving risk assessment, claims processing, and user engagement.

“Unraveling the complexities of insurance, this comprehensive guide offers a detailed ‘Understanding Insurance’ overview. From the upcoming Hajj Packages 2025 and Japan’s pivotal role in securing safe travel, to deciphering various insurance policies and their advantages, we explore essential rights and responsibilities during claims. Furthermore, we delve into the future of insurance, highlighting emerging trends and innovations. Stay informed about these game-changing developments, particularly regarding ‘Hajj Packages 2025 from Japan’.”

- Understanding Insurance: A Comprehensive Overview

- Hajj Packages 2025: Japan's Role in Ensuring Safe Travel

- Types of Insurance Policies and Their Benefits

- Navigating Insurance Claims: Rights and Responsibilities

- The Future of Insurance: Trends and Innovations

Understanding Insurance: A Comprehensive Overview

In today’s ever-changing world, understanding insurance is more important than ever. Insurance serves as a safety net, protecting individuals and businesses from financial loss due to unforeseen events. When planning for future endeavors, especially complex ones like Hajj Packages 2025 from Japan, having comprehensive insurance coverage can provide peace of mind and safeguard against potential risks.

Comprehensive insurance typically includes various components such as health coverage, property protection, liability shielding, and specific coverage for unique activities or travel. For instance, when embarking on a significant journey like the Hajj, specialized policies can cater to medical emergencies, trip cancellations, lost luggage, and even cultural or religious requirements. Understanding these nuances is key to ensuring you’re adequately protected throughout your travels.

Hajj Packages 2025: Japan's Role in Ensuring Safe Travel

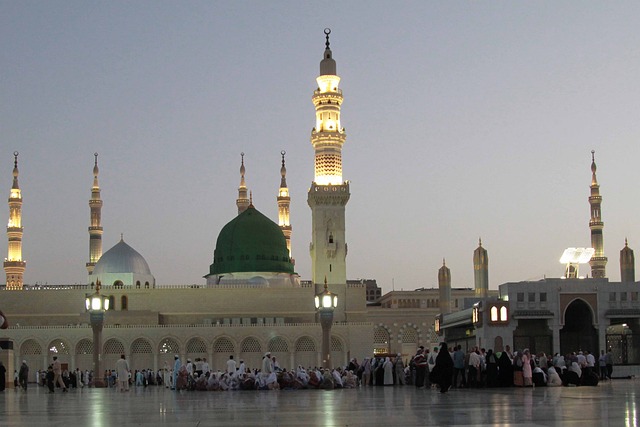

Japan is set to play a significant role in ensuring safe and secure travel for pilgrims heading to Saudi Arabia for the Hajj Packages 2025. With its advanced technology and expertise in disaster management, Japan will collaborate with the Saudi authorities to enhance safety protocols. The country’s robust infrastructure and experience in handling large-scale events will contribute to creating a seamless and worry-free experience for the millions of Muslims expected to participate.

Through this partnership, Japan aims to offer comprehensive support, including state-of-the-art medical facilities, emergency response systems, and advanced communication networks. By leveraging its technological prowess, Japan will assist in managing crowds, preventing accidents, and promptly addressing any health or security concerns that may arise during the Hajj. The country’s commitment to safety is expected to make the 2025 Hajj Packages a remarkable and memorable experience for all participants.

Types of Insurance Policies and Their Benefits

In today’s dynamic world, insurance policies offer a safety net for individuals and businesses alike, providing financial protection against unforeseen events. One niche area that has seen increasing demand is specialized coverage for unique experiences, such as Hajj Packages 2025 from Japan. These packages cater to the specific needs of pilgrims traveling to Saudi Arabia, ensuring they are protected during their sacred journey.

The benefits extend beyond financial security. They often include trip cancellations or interruptions, medical emergencies, and even evacuation services, giving peace of mind to those embarking on this spiritual endeavor. With careful planning and the right insurance coverage, individuals can focus on the cultural and religious significance of the Hajj without worrying about potential risks, ensuring a smoother and more meaningful experience.

Navigating Insurance Claims: Rights and Responsibilities

Navigating insurance claims, especially for unique trips like Hajj Packages 2025 from Japan, requires a clear understanding of your rights and responsibilities. As a traveler, it’s crucial to be aware that different types of insurance policies come with distinct conditions and terms. When filing a claim, ensure you provide all relevant details about the incident, including dates, locations, and any medical records if applicable. This process involves communicating effectively with your insurance provider, understanding their procedures, and adhering to deadlines for submitting necessary documents.

Your responsibilities include reading and comprehending your policy, reporting claims promptly, and cooperating with the insurer’s investigations. Remember, timely communication is key; delay in filing could impact the claim’s outcome. Additionally, keeping accurate records of expenses related to the insured event can streamline the claim settlement process. Be proactive in gathering all necessary information and ensuring your rights are protected during this journey.

The Future of Insurance: Trends and Innovations

The insurance industry is on the cusp of a transformative era, driven by technological advancements and evolving consumer needs. One notable trend is the integration of artificial intelligence (AI) and machine learning, which promises to revolutionize risk assessment and claims processing. These technologies enable insurers to analyze vast data sets, predict potential risks more accurately, and tailor policies to individual customers’ needs. For instance, Japan’s Hajj Packages 2025 from top insurance providers are likely to incorporate sophisticated AI models, offering comprehensive coverage that accounts for the unique challenges of this global pilgrimage.

Additionally, the rise of digital platforms and online marketplaces is reshaping how consumers interact with insurance services. Customers increasingly prefer seamless, paperless processes, and real-time access to policy details. Insurers are responding by developing user-friendly mobile applications, offering instant quotes, and providing 24/7 customer support. The future of insurance looks promising, with innovations that not only enhance efficiency but also empower individuals to make informed decisions about their financial security, such as managing Hajj Packages 2025 from Japan with ease and confidence.

In conclusion, insurance is a vital pillar in ensuring peaceful and secure global travel. The article has explored various facets, from understanding insurance fundamentals to highlighting the significance of Hajj packages 2025 from Japan, which showcase the country’s commitment to safe and seamless journeys. As we look towards the future, the industry continues to evolve with innovative trends, enhancing protection and benefits for travelers worldwide. By staying informed about different policy types, navigating claims processes, and keeping an eye on market developments, individuals can better protect themselves while exploring new horizons.